Part I: What is Token Economics (Tokenomics)?

The goal of this four-part series is to give you a standard framework for analyzing and creating token incentive models. You will gain a basic understanding of token economics’ major components (or value drivers) for crypto assets.

Part I: What is Token Economics?

Part II: Top Token Economic Models

Part III: Systematic Token Economic Issues

Part IV: A Guide to Creating a Token Incentives

You DO NOT have to be like this guy, above, to be able to understand and create the basis of your token model. You need to understand the major areas that will impact your community's long-term growth and crypto asset values.

What is Token Economics? Before I answer that, you should know B.F. Skinner, former Harvard University Psychology Professor, and his Token economy theory.

His Token economy theory was the basis for me defining the field of Token Economics.

Ok...What is Token Economics?

Token economics is the allocation of tokens to modify (or incentivize) specific behaviors to create strong communities with the underlying goal of creating a valuable crypto asset(s).

Anything that impacts crypto asset values falls under token economics.

Key Areas:

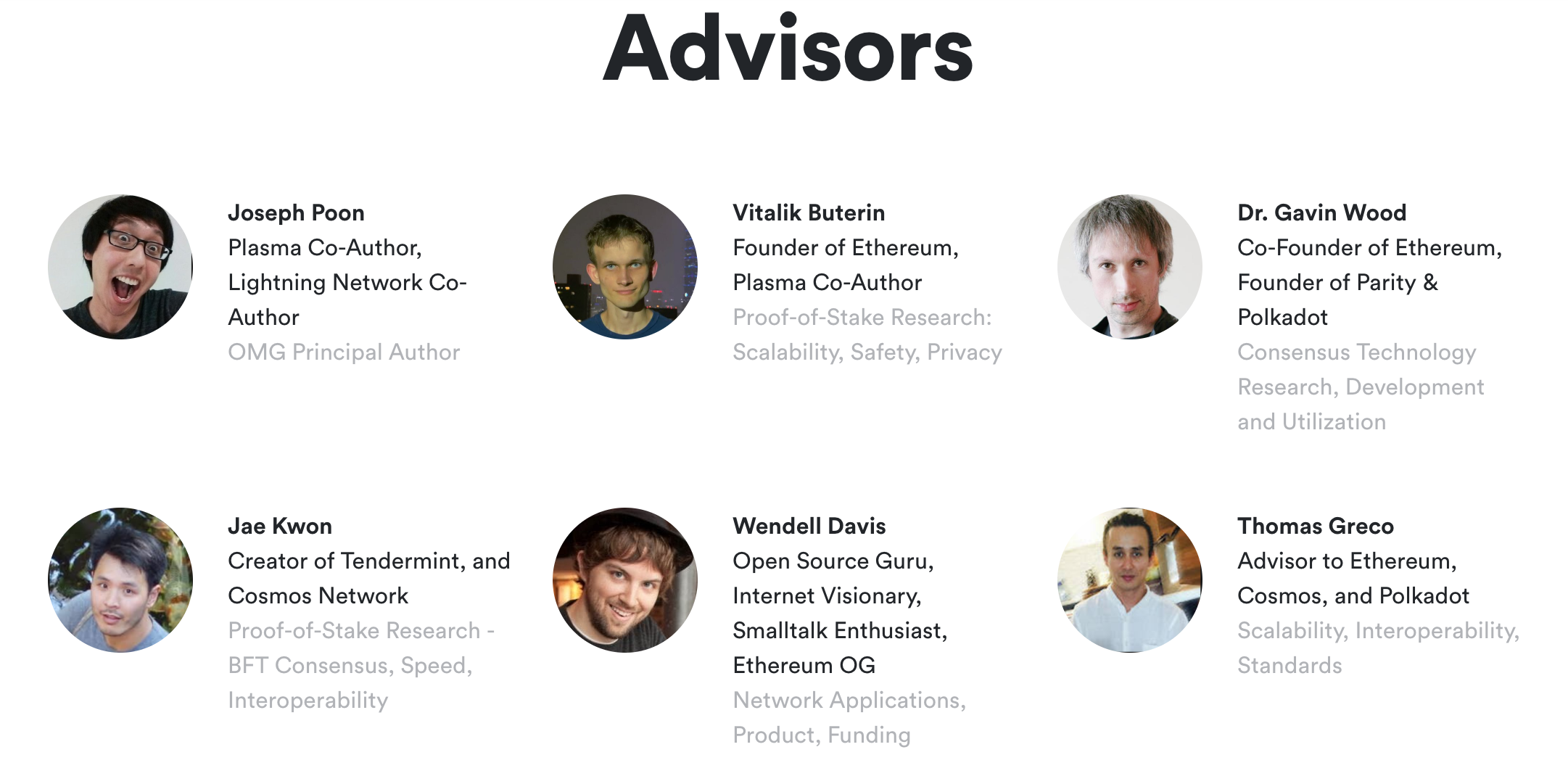

Team

The people are the most important part of an ICO project. The team behind the project is key to determining if their coin has a chance at gaining wide adoption. The team should have domain expertise in on the solution or problem and have previous successes in their career. Be sure to look for teams that have at least a 1-to-1 ratio among team members and advisors. Ideally, a project (or foundation) should have more team members (working on the idea full-time over “part-time” advisors.

*This is not the entire team. I was not able to fit the entire team on this page.*

*This is not the entire team. I was not able to fit the entire team on this page.*

You’ll notice that they have an “all-star” legal team who are crypto-asset. Cooley is representing Tezos’ Founders in their legal battle. This shows that Bitclave’s team is thinking long-term and are taking pivotal steps to being legally compliant (internationality).

2. Application Interaction Layer

Most Blockchain applications sit at the lowest interaction layer, the application layer. Some tokens such as monetary coins like Bitcoin or Monero will include all layers of interaction with exception to the application layer. Popular Decentralized applications (Dapps) like Brave, Bitclave only sit on the application layer. For detail on interaction layers, read David Xiao’s post: “The four layers of Blockchain”.

“The first four layers encompass what we think of as the Blockchain, while the application layer allows for overlays, APIs, applications, etc.” -David Xiao

Typically, the most diversified interaction layer is at the application layer. The four core layers are standard ,and most innovations will occur in the application layer because this deals with the end user. An incentive model for a decentralized Airbnb, Bee Token, looks a lot different than Dash, which uses a Masternode incentive structure for attracting miners.

Consensus - The basis for creating new blocks or making changes to the blockchain

Mining - Where new coins or tokens are minted in a proof of work or stake models

Propagation - Determines how information is transmitted between nodes in the network

Semantic - The transferring of crypto-assets to different nodes

Application - Front facing application for end-users

Once, you’ve figured out which interaction layer your Blockchain apps touches-this will put you in a better position to understand which behaviors to incentivize. This has a direct impact on the incentive models you select.

3. Token and budget allocation & fundraising goal:

I decided to lump these three areas together because it's easier to discuss them as one. Below I have included rough percentages of what I’ve seen with tokens distribution strategy and use of funds.

Token Distribution:

Founding Team: 15% - 25%

Reserve for future use and staff: 20% - 30%

Private and/or Public Sale: 25% - 50%

Community Management (Airdrops/Bounty Programs): 10% - 15%

Budget Allocation:

Research and Development: 30% - 60%

Sales and Marketing: 15% - 20%

Network Costs: 10% - 15%

Operations: 10% - 15%

Accounting, Legal & Compliance: 2.5% - 5%

*These are rough ranges and you should do your own research*

An ICO’s fundraising goal should be attainable in bear or bull market. In early 2017, ICOs had lofty fundraising goals north of $50+ million. In 2018, ICOs that tend to have the most successful raises are between $15 million or less. The key is to have all key stakeholders’ (community, foundation, and personal) interests when allocating tokens and budget.

Also, is there a lock-up period on the tokens given to the team and advisors? Long-term thinking projects tend to have founders, employees and advisors commit to a 6-12 month token lock-up period and 4-year equity-vesting periods.

Other key questions:

Will the coins be pre-mined?

Will you have an unlimited token supply?

Which exchanges will sell your tokens?

Will your team and advisors have a token lock up period?

4. Community Management (Public Relations & Branding)

Many projects with strong technical teams, often lack community emotional intelligence and empathy and proper storytelling techniques for building long term trust. Some very promising projects have forgotten about PR and never focus on controlling the narrative around their brand. ICO projects are technology branding projects. Projects with the strongest communities tend to have more stable and crypto asset values. My biggest pet peeve is to see community managers and founders show week emotional IQ when dealing with social media interactions.

One question I like to ask: “Would they talk to their mother that way?”. If the answer is no, then they are most likely going about it wrong.

Many projects with strong technical teams, often lack community emotional intelligence and empathy and proper storytelling techniques for building long term trust. Some very promising projects have forgotten about PR and never focus on controlling the narrative around their brand. ICO projects are community building projects. Projects with the strongest communities tend to have more stable and crypto asset values. My biggest pet peeve is to see community managers and founders show week emotional IQ when dealing with social media interactions.

5. Product and Business Model

How will this company make money? Projects that are off the test nets and have a working prototype have higher chances of being more valuable in the short and long-term over projects with no usable prototype. This section is self-explanatory.

Storj’s business model is to sell cloud storage space to consumers and compensate storage renters (who offer up storage space to the network) for free.

Binance’s business model is to use their coin to facilitate crypto-currency trading (i.e. lower transaction fees) on their platform. Most ICO projects will not have a usable product after launching their ICO. Some projects such as EOS or Cardona need a year or more to develop due to the scope of the problems they are trying to solve. A project with a usable product, will have stronger communities long term who are more engaged. Your community will be able to show others and get more people involved in the community.

6. Real World Use Cases and Strategic Partnerships

How will your coin be used on your platform? Can your platform be used without a coin? What are the incentives for someone to hold and spend your token in the short and long-term?

The promise of a crypto asset increasing in value over time is a worn out use case. Your token must strike a balance between providing short and long-term incentives for using their coin. The strategic partnerships created by ICOs gives more context and will make ICOs’ potential use cases, REAL. Ripple loans or discounts their XRP token to exchanges and banking institutions as a way to drive up their adoption.

7. Legal

The SEC and other government agencies have been busy this year (2018) with sending out subpoenas and shutting down scam ICOs and unregistered tokenized securities. Your ICO project should be doing everything in your control to be as legally compliant as possible. Hire a law firm or SEC law specialist and work with them to make sure you are legally compliant.

In part one, I discussed the key components of token economics. In part two, I will discuss my favorite token economic models. I would like to thank Blackchain for proofreading this post. If you have any recommendations on my analysis, feel free to share. I am not a financial advisor, and this is not investment advice. If you are interested in learning more about crypto. Subscribe to my newsletter here for latest crypto industry updates.

Donate to help fund further crypto-economic analysis:

BTC: 1LpyW83yTW4jQuDvVLW9H2vWf8SyGu8EqU

ETH: 0x0a164f29A2d08158Cc04Acb35e17Cbe9bFFFA13A

NEO: AcvZKu3gwXkuKU7aeXetBaEUGnTzsJKRv9